Showing all 15 results

-

Pillars Complete

$1,350.00 Learn More -

Financial Model Construction

$200.00 Learn More -

Advanced Financial Model Construction

$200.00 Learn More -

Cheat Sheet Bundle

$49.99 Learn More -

Advanced Excel: Formula Mastery

$200.00 Learn More -

Advanced Excel: Charting Mastery

$50.00 Learn More -

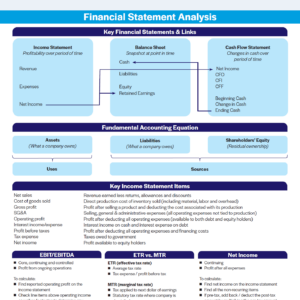

Financial Statement Analysis Cheat Sheet

$9.99 Learn More -

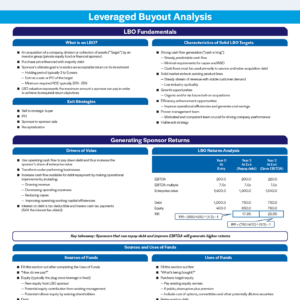

Leverage Buyout Cheat Sheet

$9.99 Learn More -

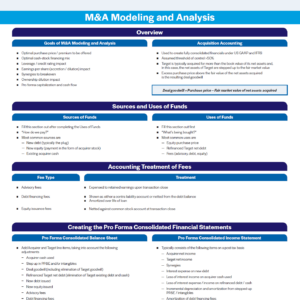

M&A Modeling and Analysis Cheat Sheet

$9.99 Learn More -

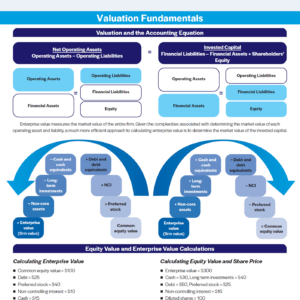

Valuation Cheat Sheet

$9.99 Learn More -

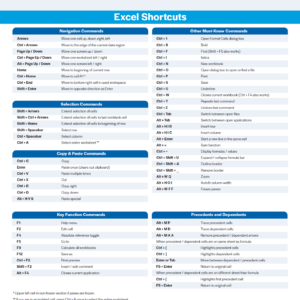

Excel Shortcuts and 3-Statement Modeling Cheat Sheet

$9.99 Learn More -

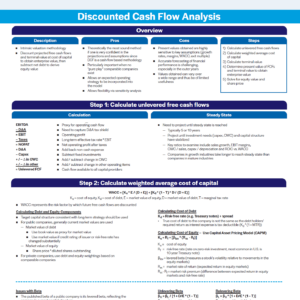

Discounted Cash Flow Analysis Cheat Sheet

$9.99 Learn More -

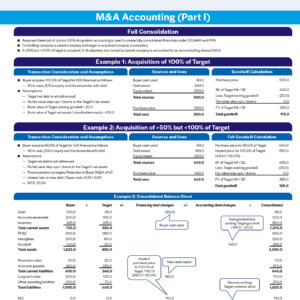

M&A Accounting Cheat Sheet

$9.99 Learn More -

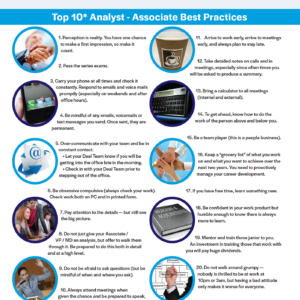

Analyst and Associate Best Practices Cheat Sheet

$2.99 Learn More -

Real Company Model Pack

$15.00 Learn More

helpful!

awesome

nice

The videos were ditaled and easy to follow. Making then easy to understand even if I could not use Excel at the moment since I’m no with my laptop.

Very helpful!

Great material.

Very helpful and informative.

Like Actually. Very Informative.

Forgot to copy taxes across on income statement

Interest income & expense misslinked

7% Interest rate on debt matrix integrity error

Total int expense on debt schedule misisng revolver

watch your formatting and the zoom. 100% minimum after save.

IS – line 13 should link to amort, PBT should start with amort

Net cash starts CFS on bottom

Cash interest calc uses average interest

Other LT assets on BS misslink

IS – EBIT margins should be off sales

IS – EBIT margin should be off sales

IS – PBT should be off EBIT

IS – Missing gross margins, Taxes should be off PBT

Debt – Missing revolver interest

IS – PBT should be off EBIT

IS – Sales growth linked incorrectly, Missing EBIT margin, EBITDA = EBIT + D&A, PBT should be off EBIT

BS – Should link to long term not current liabs

Debt – Missing revolver interest

Calcs – A/P should be off COGS

Debt – Interest should be avg balance * rate

IS – Need to include both dep and amort in line 17

IS – Missing historical D&A

IS – PBT should be off EBIT

IS – PBT should be off EBIT

Debt tab – Cash balance should not subtract revolver, Int rate is linked incorrectly

On I/S, EBITDA = EBIT + D&A

On I/S, EBITDA = EBIT + D&A

I/S – PBT should be off EBIT

I/S – Missing gross and EBIT margins

Debt – Need avg balance for revolver int calc

Debt – opening cash balance should not subtract revolver

I/S – PBT should be off EBIT

Debt tab – revolver int should be avg balance * rate

I/S – PBT should be off EBIT

I/S – EBIT margin should be off sales

I/S – Int exp should be linked up to circ switch

CFS – Hist cash balance should subtract revolver

I/S – Sales growth off by 1 column

Debt tab – revolver interest off by 1 column

I/S – PBT should be off EBIT

CFS – Opening cash balance should subtract revolver, Additions to intangibles are linking to amort

Debt tab – Int rates off by 1 column

IS – EBIT margin should be off sales

Calcs – Net income off by a column, Dividends off by a column, Share issuances should not be part of R/E

I/S – EPS calc should be off net income, Dividends should be off net income

CFS – Change in debt should not include revolver

Debt tab – int income should be avg balance * rate

I/S – Historical EBIT is incorrect, Historical PBT should be off EBIT

I/S – EBIT calc should start with gross profit, PBT should be off EBIT

Debt tab – Total int expense missing revolver

I/S – EBITDA = EBIT + D&A, Missing circ switch on interest, Interest expense should be total, not just revolver, PBT should be off EBIT, Dividends should be off net income

Calcs – Need to solve for A/R using A/R days formula, Need to solve for A/P using A/P days formula

Debt tab – There are 2 different tranches of LT debt with different interest rates – need to model out separately

I/S – Dividends should be off net income

Debt tab – Revolver int rate is incorrect

I/S – PBT should be off EBIT

Calcs – Net income in R/E off by 1 column

CFS – Other LT liabs linking to current

I/S – PBT should be off EBIT, Dividends should be off net income

I/S – PBT should be off EBIT

CFS – Dividends should be an outflow

I/S – PBT should be off EBIT

I/S – Missing historical D&A

Debt tab – Cash balance should come from the B/S

B/S – Missing cash, Revolver should be -min

Calcs – OWC formula is incorrect

Debt – int income and expense formulas should be avg balance * rate, your parenthesis is off

I/S – Missing historical EBIT, margin, D&A, EBITDA, PBT, net income, EPS

B/S – Sr notes off by 1 column

CFS – Investing CF missing intangibles in sum

I/S – PBT should be off EBIT

I/S – EBITDA = EBIT + D&A, Int expense should be the total

very fair and comprehensive test

Very simple and easy to follow, the visuals were appealing

Very helpful and concise & breaks down everything in a easy way to understand. However, sometimes the interactive freezes and even refreshing wont work. I had to sometimes restart the module again.

Profit before tax calculated off of EBIT not EBITDA

Calculated DIV as a % of CS. This should be a % of NI.

Profit Before Tax calculated off of EBIT not EBITDA

subtract revolver from net cash position on cash flow statement in column D

Matrix integrity error in AP calc on CALCS tab

Do not use IF statements for Cash / Revolver – we didn’t count off here but would be considered wrong in the real world. Only a MAX / MIN function.

PBT should be calculated on EBIT not EBITDA

Model not completed.

Matrix integrity error on div calc

Mistake in AP calculation (off of COGS not Rev)

Missing total int exp on debt schedule

Missing dividends on IS

Miss linked LT liabilities on CFS

Dividend matrix integrity error on calcs tab

AP calculation linked to REV not COGS

INT EXP calc on Senior Notes is wrong

Missing total int exp line on debt schedule

INT EXP line on IS linked to wrong row on debt schedule

LT liabilities miss linked on CFS

great questions

Perfect exam questions from concepts covered though out the course!

Challenged my understanding of the material.

Questions were well thought out and actively challenged my understanding of the material

Just wow!

Flawless execution on exam creation. Unreplaceable experience!

This exam was extremely thorough, it was a very good knowledge check.

for the if statements on interest income and interest expense, you need to complete the if statement by adding a 0 at the end. if i change the circ toggle to 0, your model says false for these line items.

You need to link the revolver line item on the debt schedule to the balance sheet to calculate interest on the revolver. you are taking the average of the years? i know you know better 🙂

also for row 34 on the debt schedule… cell d34 includes the revolver. this should just be all the long term debt. no revolver. this is why the balance sheet did not balance by 40.

Profit before taxes need to be calculated using EBIT not EBITDA

Interest income on cash needs to be calculated using an average formula

When i change the circ toggle to 0, model says false. dont forget to complete the if statement by adding a 0 at the end.

Great job!

When i change circ toggle to 0, model says FALSE… make sure to add a 0 to your if statements and close them out.

When i change your circ toggle to 0, model says FALSE. Make sure to add 0 to if statement and close it out.

Always save model with circ toggle set to 1 so there is interest in the model

Always save model with circ toggle set to 1 so there is interest in the model.

total interest expense on the income statement should link to row 35 on the debt schedule not row 25.

helpful

On debt schedule, interest income should be based on cash balance, even for the historical cash. you are using cash less revolver.

Profit before tax needs to be calculated off EBIT not EBITDA. Interest expense on the income statement is being linked to a blank cell rather than row 30 on the debt schedule. Also, must net revolver balance out of historical cash on the CFS. Historical cash should be cash less revolver

Must use average balance for calculation of interest income on cash. not only the ending balance

Interest income on cash needs to be calculated off average balance, not just ending

Profit before tax should be calculated off EBIT not EBITDA, Interest income on cash needs to be off the historical cash not cash less revolver

Profit before tax should be calculated off EBIT not EBITDA

Use the historical balances for cash and revolver from the balance sheet to link back to the debt schedule and then copy across the projected years on the debt schedule.

The historical balance sheet didn’t balance due to Total Liabilities only including the NonCurrent Liabilities. The CFS also needs to be completed.

Interest income on the debt schedule is incorrect.

Use the revolved interest rate interest expense on the revolver

Balance sheet doesn’t balance. Interest income is incorrect. Net income is incorrect.

Cash interest income on the debt schedule should use the average of ending balances. The revolver on the debt schedule should be linked the balance sheet. The revolver on the balance sheet should use a “-min”

Senior notes is 10% interest rate

Good test involving all DCF, LBO and Valuation fundamentals

It does explain comps, LBO, and DCF really clear and I finally figure out the differences among those three.

CFS – Net income on the CFS should start with projected year 1 in column F not column D, NCI net income is an add back and should link to row 27 on income statement – the NCI net income is non cash

IS – Profit before tax should be calculated off of EBIT not EBITDA

Debt schedule – Interest income should be calculated off average balance starting with column D and E – there is a matrix integrity issue

CFS – Need to start with Net income available to common

Debt – row 32 should be linking up long term debt interest, not the debt balances

IS – Need to include Circ toogle

Calcs – Capex needs to be a % of sales not gross profit

CFS – missing amortization in CFO, CFI – Capex and additions to intangibles need to be negative, CFI – you dont need row 19, you have already accounted for the NCI net income and the NCI dividends

BS – make sure to include formulas for cash and revolver to balance the model

Interest rate for interest income on cash is mislinked, need to be linking to column E in the first year for the interest rate and this way you will be interest income each year

IS – Profit before tax should be based on EBIT not EBITDA, Net income available to common needs to subtract NCI net income not add it, Missing circ toogle for years 2 through 5

CFS – Needs to start with Net income available to common,

BS – total liabilities calculation needs to include current liabilities

Calcs – RE earnings needs to be calculated with Net income available to common

Missing interest rate on calculation of interest income in year 5 on debt schedule. this is a result of a matrix integrity error

IS – profit before taxes needs to subtract interest expense, not add it

interest income on cash needs to be calculated off of average formula… you are just using the ending balance

=IF(ABS(Total Assets-Total liabilities and equity>0.001),Total Assets-Total liabilities and equity,0)

More Dynamic

Eric, Thanks for your comment. You do not want to do the above for a number of reasons that frankly won’t fit in a comment reply box. Suffice it to say, that a balance sheet check should always be formatted to 0.000 decimal points, and should never have an IF statement (or anything else for that matter!)

Matt DeFeo

Holds your hand yet expects reasonable competency. Would highly recommend.

Video made sense and was easy to follow could have gone faster if he waned to

I enjoyed.

Great shortcuts

great

Funky music

Broke down finance concepts I previously thought of as too complicated such as Eq/Enter value, DCFs. LBOs, and more!

Very helpful. I found the interactives helpful but they did sometimes glitch and not let me redo the problem if I made a mistake, and wouldn’t let me see the correct answer.

Great

Great course!

It does explain comps, LBO, and DCF really clear and I finally figure out the differences among those three.

Easy to follow

Good

Good

Great course

good

Peter was great!

Great course! Peter is a great teacher

Peter gave us the confidence necessary to hit the ground running!

good exam

Interest Income formula off.

Error in Profit before tax formula

Error in Interest Expense linking

Model has circularity bust because revolver was included in FCF. This should be part of net cash reconciliation.

1) Revolver on debt schedule in opening balance should be in cell D7

2) Linked E7 to D7 instead of the BS on debt schedule

3) On IS Interest expense linked to wrong cell on debt schedule

4) Historical PBT calculated off of EBITDA

5) Projected PBT linked to EBIT

Double counted D&A in PBT on IS

Numerous errors. please see your instructor to walk through the model and plan for a retest on Monday.

Model circularity turned off – lots of highlighting left in model by the way. this should be removed before “finishing”

Missing revolver from net cash on bottom of CFS. this is why BS doesn’t balance.

Inventory formula wrong on calcs

AP formula wrong on calcs

Missing circ toggle on interest income

PBT formula incorrect

There are numerous errors in this model, many arising from matrix integrity issues. Please contact your instructor Monday morning to review. A take home assessment will be provided Monday evening.

1) Revolver is netted from cash on CFS, not included in CFF

2) PBT calculated off of EBIT not EBITDA

1) circ switch should be turned on. Formatting needs to be fixed (highlighting etc…)

2) PBT calculated off of EBIT not EBITDA

Circ switch on interest income messed up throughout the years

Circ switch on interest expenses messed up through the years

Missing circ switch

1) RE misslink on opening calcs balance

2) Taxes misslink with matrix integrity error

1) revolver must be netted on CFS from opening cash. Subtracting only works if CF available to pay down debt is in excess of the revolver.

2) Cash missing max function on BS

Missing cash reconciliation on the CFS.

Revolver on balance sheet was linking to a blank line on the cash flow statement rather than the Cash/(revolver) line on the cash flow

Revolver on Balance sheet was mislinked on cash flow statement, Calculation of inventory on calculations worksheet should be based on COGS not Sales

Change in other long term assets on cash flow statement was incorrect should be prior year minus current

On the income statement, the circ formal for interest income is wrong.. should be =1 not 0, On the debt schedule the formula for interest expense on the revolver needs to be multiplied by the revolver interest rate

Circ formula on interest income and interest expense needs to include 0, when toggle is changed to 0 it says false

debt schedule needs a calculation for total interest expense,

On income statement, interest expense is linked to interest income on debt schedule

On debt schedule senior note interest expense needs to be calculated using average formula

you reversed the links for interest income and interest expense on the income statement. as soon as i relink these, the model is perfect… big picture, slow down and always triple check your work

matrix integrity error in calculation of inventory on calcs page. you are in column E and linking to assumptions in column d

always save model with circ toggle set to 1 so anyone reviewing your model sees the impact of financing costs on the model

circ formulas for interest income and interest expense on income statement are incorrect.. you have if circ=circ… should be =1

On income statement, calculation of profit before tax needs to based on EBIT not EBITDA

On income statement, calculation of profit before tax needs to be based on EBIT not EBITDA

Profit before tax on income statement needs to be calculated off EBIT not EBIDA

Profit before taxes needs to be calculated off EBIT not EBITDA

Interest expense on the income statement needs to be total interest from the debt schedule… you have only linked in bank debt interest

when circ toggle is set to 0, model says false. dont forget to close out your if statements for interest income and interest expense at the end with a 0

You need to either name the circ toggle circ or when you write your formulas for interest income and interest expense and you reference the toggle, lock it with an F4

Profit before taxes needs to be calculated off EBIT not EBITDA

Few comments – make sure to complete all interest calculations on your debt schedule, and to link totals from there to the IS. this got you in to trouble in the model. Your interest calc on the IS excludes all interest on the revolver. Having cash interest on the CFS is not good modeling technique.

In non-cash sweep model revolver is netted from cash. you put it in CFF which created a circularity error in your model.

I have never had more fun in my life — Amazing assessment